A Combined Ratio Measures Which of the Following

Iv It regulates the flow of credit. ROAs over 5 are generally considered good however take with caution because ROAs vary significantly between industries.

Price To Earnings P E Ratio Definition Earnings Price Ratio

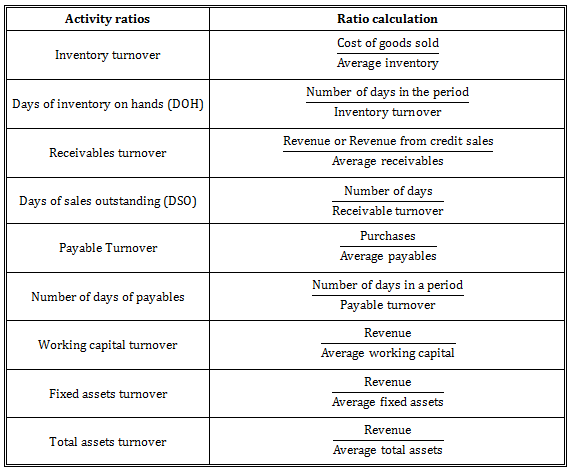

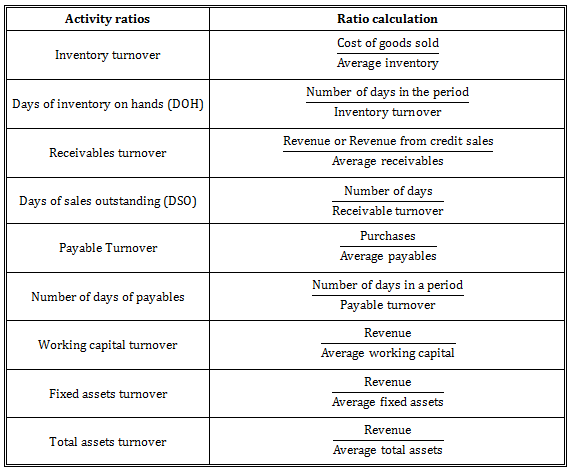

Activity Ratios or Turnover Ratios 2.

. It can be looked at as an insurers cost of. I and III only D. You just studied 7 terms.

A It is equal to the loss ratio minus the expense ratio. It must always be below 100 for the insurer to show a net profit. The financial basis gives a snapshot of the current years statutory financial statements.

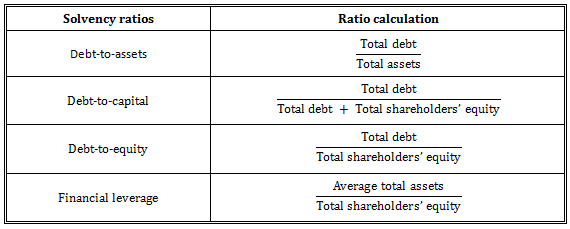

The combined ratio is the sum of the underwriting loss ratio and the expense ratio. A measure the amount of debt the firm uses. III and IV only.

Ratio analysis over-complicates the financial statement review process. The Combined Ratio After Dividends CRAD is a metric that is used to evaluate the profitability of insurance companies. Losses indicate the insurers discipline in underwriting policies.

Debt ratio 59 Total debt76 m. Given assets are invested capital this ratio tells how much income was returned for that investment. Which of these ratios show the combined effects of liquidity asset management and debt management on the overall operation results of the firm.

The financial basis combined ratio is 1 or 100 10 million 15 million25 million. The combined ratio measures the money flowing out of an insurance company in the form of dividends expenses and losses. The CRAD ratio starts from the combined ratio.

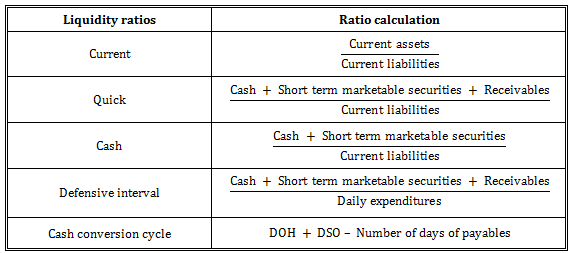

B measure how effectively a firm is managing its assets. 760 per share. Which of the following ratios are measures of a firms liquidityI.

Activity Ratios or Turnover Ratios. The following ratios and data were computed from the 1997 financial statements of Star Co. C show the relationship of a firms cash and other current assets to its current liabilities.

It measures the total efficiency and is more comprehensive than the combined ratio. Which of the following is not true of the combined ratio. In this article we will discuss about the classification of combined ratios in accounting.

Combined Ratio 97 985 Premium to Surplus Ratio 251 3251 Current Ratio 161 131 The analysis is most limited by the fact that A. Success ratio Which one of the following represents two nonfinancial measures that are used to evaluate underwriting performance by focusing on. Iii It is the banker of other banks.

Which of the following ratios measures long term solvency a Acid test ratio b. Total equity 76 m. A combined ratio measures the money flowing out of an insurance company in the form of dividends expenses and losses.

Income before interest and taxes. Book value of equity 3116 m41 m. Losses indicate the insurers discipline in underwriting policies.

Asked Aug 23 2019 in Business by YokoUno. C The combined ratio considers the companys investment income. Which of the following ratios measures long term solvency a Acid test ratio b from ACCOUNTING 103-3 at University of Perpetual Help System DALTA - Las Piñas.

Ratios cannot be used to compare relative performance of companies in the same industry. It consists of the loss ratio and the expense ratio. D show the combined effects of all areas of the firm on operating results.

Income before interest and taxes. B A combined ratio greater than 1 or 100 percent means an underwriting loss has occurred. The combined loss of all operating segments that did incur a loss.

The profit margin ratio measures the _______________ earned. Market value ratios. This category of ratios includes those ratios which highlight upon the activity and operational efficiency of the business concern.

The combined ratio CR in insurance is an important measure that is used to assess the profitability of Property Casualty PC Insurance companies. Tap card to see definition. Fixed asset turnover ratioII.

In particular the CRAD is often calculated to determine the profitability of Property and Casualty Insurance PC companies. I It is the Bank of Issue. Which ratio measures the operating return on the firms assets irrespective of financial leverage and taxes.

Current ratio 15 Working capital P20000 Debtequity ratio 8 Return on equity 2 If net income for 1997 is P40000 the balance sheet at the end of 1997 total assets of. I III and IV only C. II and IV only B.

The dividend payout ratio is calculated by dividing total dividends by. In simpler terms ROA measures how well a company utilizes its assets to generate income. Ii It acts as banker to the Government.

It can be used to determine whether the current market is hard or soft. D A combined ratio less than 1 or 100 percent indicates an underwriting loss has occurred. Market to book ratio.

I II and III only E. Total debt 59 x 76 m. Which of the following is true about the functions performed by RBI.

Both i and ii B. It is a measure of underwriting profitability.

Cfa Level 1 Financial Ratios Sheet Analystprep Cfa Exams

:max_bytes(150000):strip_icc()/dotdash_INV_final_Capitalization_Ratios_Jan_2021-01-39b098a2a4f645ddb752bbd1887a488c.jpg)

Capitalization Ratios Definition

Pin By Megan Escobar Olsen On Math 7 Math Lessons Middle School Math Algebra Worksheets

Leverage Ratios Debt Equity Debt Capital Debt Ebitda Examples

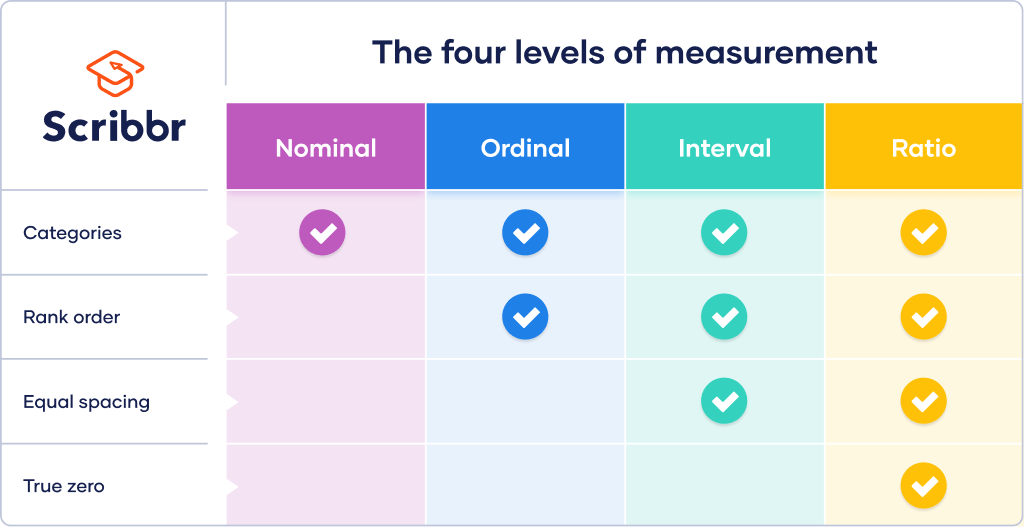

Scales Of Measurement Nominal Ordinal Interval Ratio Scale Data Youtube

Reflectix 48 In X 25 Ft Double Reflective Insulation Roll Bp48025 The Home Depot In 2021 Ship Lap Walls Storage Kits Installing Shiplap

Ordinal Data What Is It And What Can You Do With It

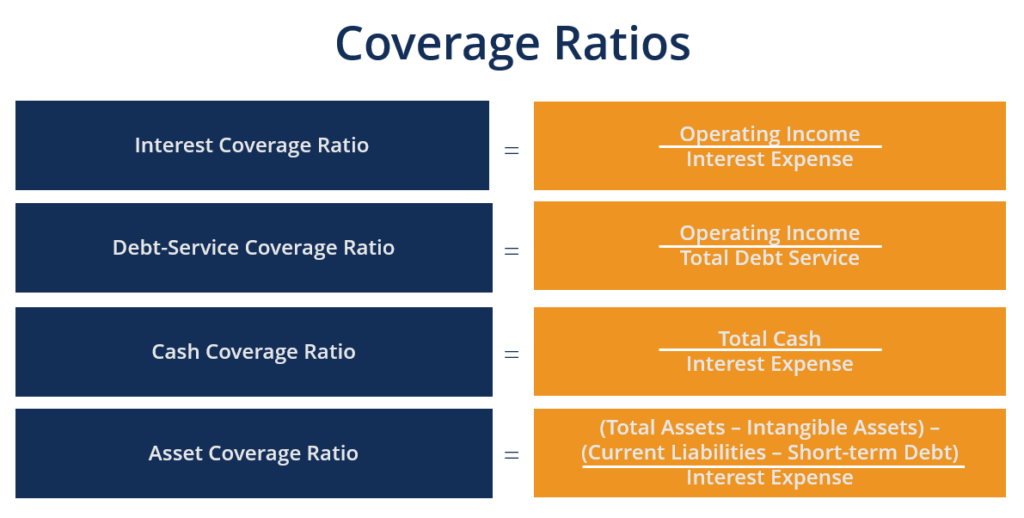

Coverage Ratio Guide To Understanding All The Coverage Ratios

Efficiency Ratios Overview Uses In Financial Analysis Examples

5 Tools To Evaluate Mutual Funds Alpha Sharpe Ratio Beta R Squared Financial Life Hacks Mutual Funds Investing Economics Lessons

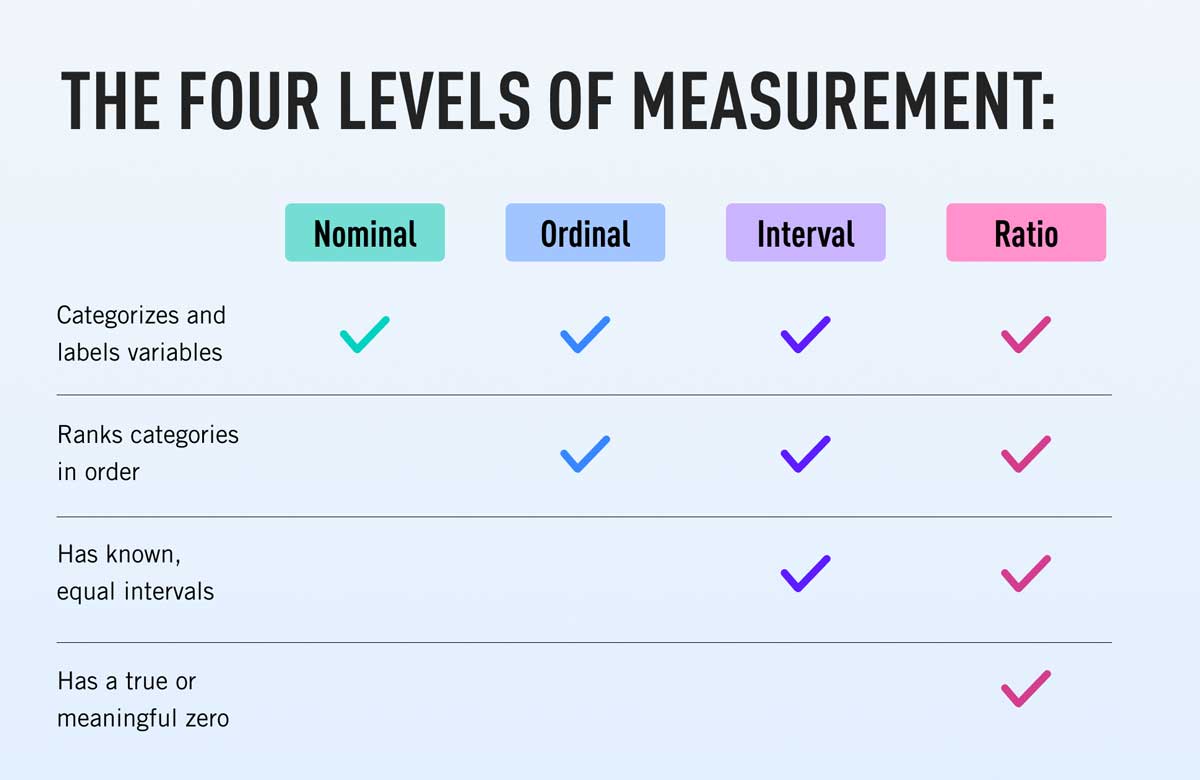

Levels Of Measurement Nominal Ordinal Interval Ratio

Degree Of Total Leverage Meaning Calculation Importance And More Financial Ratio Learn Accounting Accounting And Finance

Pin By Do Thanh On Business In 2020 Financial Analysis Financial Statement Analysis Cheat Sheets

Cfa Level 1 Financial Ratios Sheet Analystprep Cfa Exams

Cfa Level 1 Financial Ratios Sheet Analystprep Cfa Exams

The Goal Of Six Sigma Is To Improve Your Processes Like How To Fix Variation And Products And I Business Management Degree Business Management Lean Six Sigma

Comments

Post a Comment